Pay Zakat online: Best Charities & Guide 2024

Why Paying Zakat Matters Now More Than Ever

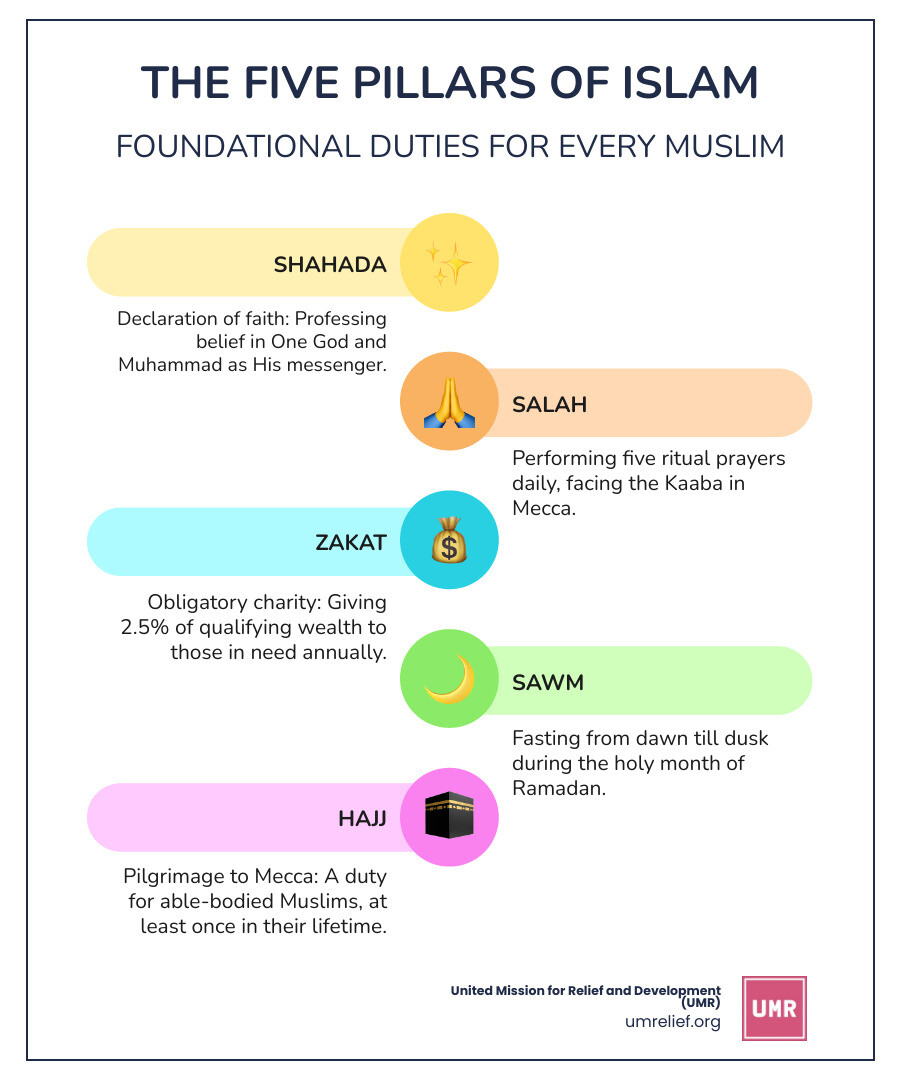

Zakat is one of the Five Pillars of Islam and a sacred obligation for every eligible Muslim. It means “purification” in Arabic—when you pay your 2.5% on qualifying wealth, you’re not just fulfilling a religious duty. You’re purifying your remaining wealth and helping lift communities out of poverty.

The impact is staggering. Zakat distributed by major charities reaches millions of people through thousands of projects worldwide. If just the ten richest people in the world paid their Zakat, it would generate over $9 billion for those in need.

With the rise of online platforms, it’s never been easier to Pay Zakat online. However, many Muslims still face confusion about how to calculate Zakat correctly and which organizations to trust. This guide will walk you through everything you need to know to donate with confidence.

I’m Caroline Evashavik, and at United Mission for Relief and Development (UMR), I’ve helped grow our digital engagement by over 3,200% while ensuring transparent, impactful ways for donors to Pay Zakat online. My experience has taught me what matters most: making it simple for you to fulfill your sacred obligation while maximizing your impact.

Here’s how to get started:

- Use a Zakat calculator to determine your obligation.

- Choose a reputable charity with scholar-verified policies.

- Select your payment method (credit card, bank transfer, PayPal).

- Make your intention and donate before your lunar year ends.

Understanding Zakat: An Essential Pillar of Islam

Zakat is one of the Five Pillars of Islam, a transformative act that purifies our wealth and souls. The word “Zakat” means “to purify” and “to grow.” By giving a portion of our wealth, we purify what remains and invite blessings into our lives. It’s a spiritual practice that removes greed and allows gratitude to flourish.

Zakat is mandatory for every sane, adult Muslim whose wealth meets or exceeds the Nisab (a minimum threshold) for a full lunar year, known as the Hawl. This recognizes that all wealth belongs to Allah (SWT), and we are merely its stewards. The spiritual importance of Zakat is immense, cultivating humility and strengthening community bonds, with rewards multiplying during blessed times like Ramadan. To learn more, explore The Benefits of Giving Zakat and Sadaqah in Ramadan.

While often mentioned together, Zakat is an obligatory annual payment, whereas Sadaqah is voluntary charity given anytime. Both are acts of worship, but Zakat is a religious duty. Curious about the differences? Check out What is Sadaqah?

The Two Main Types of Zakat

Zakat al-Mal is the annual 2.5% payment on accumulated wealth—cash, gold, silver, investments, and business assets—that has been held for a full lunar year above the Nisab threshold. This is the Zakat most people calculate and Pay Zakat online. For a comprehensive look, visit What is Zakat Al-Maal.

Zakat al-Fitr (or Fitrana) is a smaller payment made during Ramadan before Eid al-Fitr prayers. It purifies our fasts and ensures every Muslim can celebrate Eid with dignity. The amount is typically a small fixed sum per person in the household. Learn more at What is Zakat Al-Fitr?

Who Can Receive Zakat?

The Qur’an (9:60) explicitly names eight categories of people eligible to receive Zakat, ensuring it creates a more equitable society. At UMR, we follow these categories strictly:

- Al-Fuqara (The Poor) – Those with wealth below the Nisab.

- Al-Masakin (The Needy) – Those in severe hardship lacking daily necessities.

- Al-Amileen (Zakat Administrators) – Those appointed to collect and distribute Zakat.

- Al-Muallafatu Quloobuhum (Those whose hearts are inclined toward Islam) – New converts or allies.

- Ar-Riqab (To free those in bondage) – Today, this can include victims of trafficking or unjust imprisonment.

- Al-Gharimin (Those in debt) – People burdened by lawful debt they cannot repay.

- Fi Sabilillah (In the cause of Allah) – This can include humanitarian aid and community projects.

- Ibn as-Sabil (Travelers/Wayfarers) – Those stranded or displaced, including refugees.

A common question is: Can you give Zakat to a family member? Yes, if they fall into an eligible category and are not your direct dependents (spouse, children, parents), whom you are already obligated to support.

As for non-Muslims, the majority of scholars say Zakat is prescribed for Muslims. However, there are nuanced scholarly discussions about specific contexts where non-Muslims might qualify, such as refugees in desperate need. For complex situations, we always recommend consulting a qualified scholar. Learn more about this topic here: Can Zakat be given to non-Muslims?

How to Calculate Your Zakat Accurately

Calculating Zakat is a straightforward formula: know your threshold (Nisab), confirm you’ve held your wealth for a full year (Hawl), and then apply the 2.5% rate.

The Nisab is the minimum wealth you must possess before Zakat is obligatory. It’s traditionally pegged to the value of either 87.48 grams of gold or 612.36 grams of silver. The Hawl is one complete lunar year (approx. 354 days) that your wealth must remain above the Nisab. The Zakat rate is 2.5% of your qualifying wealth.

As of June 11, 2024, the silver standard Nisab is approximately $789.94, while the gold standard is around $8,957.95. Many scholars and organizations lean toward the silver standard because it allows more people to participate in giving, aligning with Zakat’s purpose of supporting the needy. We encourage you to consult a trusted scholar to determine which standard is most appropriate for you. For a deeper understanding of How much Zakat to pay?, consider both standards.

Online Zakat calculators, available through many reputable organizations, eliminate guesswork and ensure accuracy, making it easy to Pay Zakat online with confidence.

What Constitutes Zakatable Wealth?

Not everything you own is subject to Zakat. Understanding what’s included and what’s exempt is key for an accurate calculation.

| Zakatable Assets | Exempt Assets |

|---|---|

| Cash (in hand, bank accounts, savings, money owed to you) | Primary residence (home you live in) |

| Gold (jewelry, bars, coins) | Personal vehicles (cars used for daily transport) |

| Silver (jewelry, bars, coins) | Clothes, furniture, and household appliances for personal use |

| Business Inventory (goods for sale, valued at selling price) | Tools or equipment used for your profession |

| Stocks, Shares, and Investments (current market value) | Food and provisions for immediate consumption |

| Rental Properties (Zakat on rental income, not the property itself unless for sale) | Long-term debts (like mortgages, though short-term debts are deductible) |

| Pensions and Retirement Funds (if accessible and meet Nisab) | Precious stones (e.g., diamonds, rubies) in jewelry, separate from gold/silver |

Regarding loans, short-term liabilities (like bills or credit card debt due within the year) can generally be deducted from your assets before calculating Zakat. However, long-term debts like a mortgage on your primary home typically are not. For specific questions like Do you pay Zakat if you have loans?, consulting a scholar is always wise.

How to Pay Zakat Online for Business or Investments

For business owners, Zakat on business inventory is calculated on the total current selling price of all goods in stock. For investors, Zakat on stocks and shares is typically calculated on the current market value of your holdings. For rental properties, Zakat is due on the net rental income you’ve saved throughout the year, not on the property’s value itself (unless it’s for sale).

Consulting a scholar for complex assets like cryptocurrencies, intricate business partnerships, or specialized investments is highly recommended. At UMR, we believe in making things easy, but expert advice is the most responsible path for complex situations.

A Step-by-Step Guide to Pay Zakat Online

The digital age has transformed how we fulfill our sacred obligations. Today, you can Pay Zakat online in minutes, making it easier to focus on the intention behind your giving.

The benefits are clear: convenience, global reach, transparency, and speed. Your Zakat can reach a family in Yemen or a refugee in Gaza almost instantly, and reputable charities provide detailed reports showing where funds go. This accountability gives you confidence that your obligation is being fulfilled properly.

Many wonder, When do I pay Zakat? Zakat is due once a full lunar year (Hawl) has passed since your wealth first met the Nisab. While you can pay on that anniversary, many Muslims choose to pay during Ramadan to maximize rewards. It is also permissible to pay in advance or spread payments throughout the year with recurring monthly donations, as long as the full amount is paid by your Hawl date.

How to Choose a Reputable Charity to Pay Zakat Online

Entrusting your Zakat is a major decision. Look for organizations with scholar-verified policies, where qualified Islamic scholars have reviewed and approved their Zakat distribution methods. Some even have independent Zakat Advisory Boards to ensure Shari’ah compliance.

Transparency in fund distribution is non-negotiable. Check if the organization provides clear reports on where Zakat goes. At UMR, we’re proud to show our work across healthcare, clean water, and education programs in places like Jordan, Lebanon, Somalia, and Gaza.

Regarding administrative fees, some organizations advertise “100% Zakat policies,” covering operational costs through other funds. Others transparently include these costs as part of Zakat distribution, which is Shari’ah-compliant as Zakat administrators (Al-Amileen) are a valid category of recipients. The key is honesty about how your donation is used.

Finally, verify charity credentials. Look for official nonprofit registrations, like 501(c)(3) status in the US, and good governance awards. Some donors prefer specialized, scholar-endorsed Zakat programs that focus on specific vulnerable populations. Choose an organization whose mission and track record give you peace of mind.

Finding the Best Online Payment Options

Once you’ve chosen a charity, the process to Pay Zakat online is simple. Most major humanitarian organizations, including UMR, maintain dedicated charity websites with secure Zakat portals, calculators, and instant receipts.

In some countries, you can use government portals like BAZNAS in Indonesia. There are also regional platforms like eZakat in Brunei and Malaysia. These platforms often provide localized guidance and payment methods.

Common payment options include:

- Credit and debit cards

- PayPal

- Bank transfers

- E-wallets and virtual accounts (popular in certain regions)

Simply steer to your chosen organization’s Zakat page, enter your details, and complete the transaction. Your sacred obligation is fulfilled, and help is on its way.

The Impact of Your Zakat: Where Do Donations Go?

When you Pay Zakat online, your contribution becomes a lifeline for families, a chance at education for a child, or clean water for a community.

The numbers tell a powerful story. Major charities distribute Zakat to millions of people each year, providing aid in more than 40 countries worldwide. At UMR, we’re on the ground in Jordan, Palestine, Lebanon, Sudan, Kenya, Yemen, Pakistan, Bangladesh, Somalia, Gaza, Turkey, and the United States, running sustainable projects that break the cycle of poverty.

Your Zakat supports critical areas:

- Food Security: In Gaza, Zakat donations have provided thousands of ready-to-eat meals for families struggling to survive.

- Clean Water: When you Build a Water Well in Islam, you provide safe drinking water that transforms entire communities for years.

- Shelter: Following disasters like the earthquakes in Turkiye and Syria, Zakat provides emergency shelter and helps families rebuild.

- Healthcare: Donations fund critical medical equipment and services for vulnerable populations.

- Education: Your Zakat removes barriers that keep children out of classrooms, giving them a chance at a brighter future.

- Livelihood Support: We empower people to become self-sufficient by helping them start small businesses or providing tools and training.

- Orphan Care: Zakat for Orphans can change the trajectory of their lives by covering living costs, medical care, and food.

Your Zakat is a sacred trust and a powerful tool for justice. When you Pay Zakat online through trusted organizations like UMR, you’re investing in hope, dignity, and lasting change.

Frequently Asked Questions about Paying Zakat

Here are answers to some of the most common questions we hear from donors about fulfilling their Zakat obligation.

I owe Zakat for several past years, how do I calculate and pay it?

It’s never too late to fulfill a missed obligation. Go back to each year you missed and make your best honest estimate of your zakatable wealth for that year (cash, gold, investments, etc., minus immediate debts). Then, calculate 2.5% of that wealth for each year and add the amounts together to get your total.

When you’re ready to Pay Zakat online, make a clear intention that this is for your missed (Qadha) Zakat. Reputable charities confirm this approach, and you can pay the full amount at once through their online portals.

Can I pay my Zakat in installments throughout the year?

Yes, many people find it easier to manage their finances by spreading out Zakat payments. Many organizations support this practice and allow you to set up recurring monthly donations.

The key is to calculate your total annual Zakat obligation first. Then, you can divide that amount to determine your monthly payment. Most online platforms make it easy to set up recurring payments. Just ensure your full Zakat amount is paid by your Hawl date (the anniversary of when your wealth first reached Nisab).

Is my 401k, pension, or other retirement fund subject to Zakat?

This is a complex issue with differing scholarly opinions, as these accounts are modern financial instruments.

The answer often depends on accessibility. If your retirement fund is immediately accessible (even with a penalty), many scholars advise including it in your zakatable wealth. You would pay 2.5% on the accessible portion.

If the funds are locked until retirement, opinions diverge. Some scholars say Zakat is not due until you receive the funds. Others argue it is due annually on the growth or principal amount. Given these varying perspectives, the best practice is to consult a qualified Islamic scholar. They can provide guidance based on your specific fund’s terms, ensuring you fulfill your obligation correctly.

Conclusion: Fulfill Your Sacred Duty Today

Zakat is more than a requirement; it’s a sacred act that connects us to our faith, our community, and people whose lives we can profoundly touch. It purifies our wealth and sustains a beautiful system of compassion.

Today, fulfilling this ancient obligation has never been more accessible. When you Pay Zakat online, you’re not just sending money; you’re funding clean water wells, providing meals to hungry children, and offering hope to communities facing unimaginable hardship. The ease and security of online platforms mean your Zakat can begin its journey to someone in need within minutes.

At United Mission for Relief and Development (UMR), we’ve witnessed how your generosity transforms lives. Operating in places like Gaza, Yemen, Sudan, and right here in the US, your Zakat funds sustainable projects that break cycles of poverty and create lasting change. We are committed to making the process simple and transparent, ensuring every dollar you entrust to us is handled with care and channeled into programs with real, measurable impact.

Don’t wait. Your Zakat is due, and families are waiting. Take a few minutes today to calculate your obligation and Pay Zakat online with confidence, knowing you’re fulfilling a pillar of your faith while making a real difference.

Explore UMR’s Zakat-eligible programs and fulfill your obligation